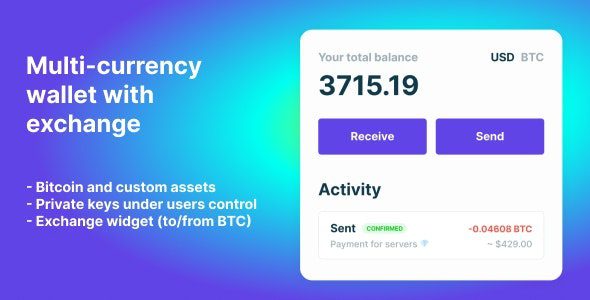

Bitcoin, Ethereum, ERC20 crypto wallets with exchange 1.1.1532

Bitcoin, Ethereum, and ERC20 Crypto Wallets with Exchange Functionality: A Comprehensive Guide

Navigating the world of cryptocurrency can be daunting, especially when choosing the right tools to manage your digital assets. This guide focuses on Bitcoin, Ethereum, and ERC20 tokens, exploring the nuances of crypto wallets that offer integrated exchange functionalities. We’ll delve into different wallet types, security considerations, and the benefits of having exchange features built directly into your wallet. This information will equip you to make informed decisions about selecting a wallet that aligns with your crypto needs.

Understanding Bitcoin, Ethereum, and ERC20 Tokens

Before diving into wallets, it’s crucial to understand the core cryptocurrencies and token standards we’re discussing:

- Bitcoin (BTC): The first decentralized cryptocurrency, Bitcoin operates on its own blockchain and is primarily used as a store of value and a medium of exchange.

- Ethereum (ETH): A blockchain platform with its own cryptocurrency (Ether), Ethereum enables the creation of smart contracts and decentralized applications (dApps).

- ERC20 Tokens: A technical standard for creating tokens on the Ethereum blockchain. ERC20 defines a set of rules that all tokens must follow, ensuring interoperability and ease of integration with wallets, exchanges, and other decentralized applications. Many popular cryptocurrencies and utility tokens are ERC20 tokens.

Types of Crypto Wallets

Crypto wallets come in various forms, each with its own trade-offs in terms of security, convenience, and accessibility. Understanding these different types is essential for choosing the right wallet for your needs.

Software Wallets

Software wallets are applications that you install on your computer or mobile device. They offer a balance of convenience and security, making them a popular choice for everyday crypto users.

- Desktop Wallets: Installed on your computer, these wallets offer more control and security compared to online wallets but are tied to the specific machine.

- Mobile Wallets: Designed for smartphones, mobile wallets allow for convenient access to your crypto on the go. They are often user-friendly and ideal for making quick transactions.

- Web Wallets: Accessed through a web browser, web wallets are convenient but generally less secure as your private keys are stored on a third-party server. It is very important to choose trusted service providers.

Hardware Wallets

Hardware wallets are physical devices that store your private keys offline, making them the most secure option for storing large amounts of cryptocurrency.

- Dedicated Hardware Devices: Specialized devices like Ledger and Trezor store your private keys offline and require physical confirmation for transactions, protecting against hacking and malware.

Paper Wallets

A paper wallet involves printing your private and public keys on a piece of paper. While highly secure when created and stored properly, they are cumbersome for frequent transactions.

- Printed Keys: Generating a pair of keys and QR codes and printing them provides offline storage, but this method is susceptible to physical damage or theft of the paper.

Custodial vs. Non-Custodial Wallets

Another important distinction is between custodial and non-custodial wallets.

- Custodial Wallets: A third party holds your private keys, similar to a bank holding your money. While convenient, you relinquish control over your funds. Exchanges typically use custodial wallets.

- Non-Custodial Wallets: You control your private keys, giving you full ownership of your cryptocurrency. This requires greater responsibility in securing your keys.

Benefits of Crypto Wallets with Integrated Exchange Functionality

Traditional crypto exchanges require you to deposit your cryptocurrency onto their platform to trade it. Wallets with integrated exchange functionalities offer a more streamlined and potentially secure approach.

- Convenience: Buy, sell, and trade cryptocurrencies directly from your wallet without transferring funds to an exchange.

- Security: Keep your funds in your own custody while trading, reducing the risk of exchange hacks and fraud.

- Efficiency: Save time and transaction fees by eliminating the need to move funds between your wallet and an exchange.

- Privacy: In some cases, integrated exchanges can offer more privacy compared to centralized exchanges that require KYC (Know Your Customer) verification.

Features to Look for in a Crypto Wallet with Exchange

When choosing a crypto wallet with exchange functionality, consider the following features:

- Security: Strong password protection, two-factor authentication (2FA), and multi-signature support are essential security features.

- Supported Cryptocurrencies: Ensure the wallet supports Bitcoin, Ethereum, and the ERC20 tokens you want to manage.

- User Interface: A clean and intuitive interface makes it easy to navigate the wallet and execute trades.

- Exchange Fees: Compare the exchange fees charged by different wallets and choose one that offers competitive rates.

- Exchange Liquidity: Wallets connect to various exchanges, therefore ensure liquidity is sufficient to execute trades without slippage.

- Privacy Features: Look for wallets that offer privacy-enhancing features such as Tor integration or coin mixing.

- Customer Support: Reliable customer support is crucial if you encounter any issues with the wallet or exchange functionality.

- Reputation: Research the wallet provider’s reputation and track record before entrusting them with your funds.

Popular Crypto Wallets with Integrated Exchange Functionality

Several popular crypto wallets offer integrated exchange features. Here are a few notable examples:

- Exodus: A user-friendly desktop and mobile wallet that supports a wide range of cryptocurrencies and offers a built-in exchange powered by third-party providers.

- Trust Wallet: A mobile wallet owned by Binance that supports a vast array of cryptocurrencies and offers a decentralized exchange (DEX) interface.

- Coinbase Wallet: A separate, non-custodial wallet from the Coinbase exchange, allowing users to store their crypto and access decentralized applications. It also offers integrated trading functionality.

- MetaMask: A browser extension and mobile wallet primarily focused on Ethereum and ERC20 tokens, MetaMask allows users to interact with decentralized applications and exchange tokens through integrated DEX aggregators.

- Ledger Live: The companion app for Ledger hardware wallets, Ledger Live allows users to manage their crypto and exchange assets directly from their hardware wallet.

- Trezor Suite: Similar to Ledger Live, Trezor Suite provides a user interface for managing Trezor hardware wallets and offers integrated exchange functionality.

Security Best Practices for Crypto Wallets

Regardless of the type of wallet you choose, following security best practices is crucial to protect your cryptocurrency.

- Strong Passwords: Use strong, unique passwords for your wallet and exchange accounts.

- Two-Factor Authentication (2FA): Enable 2FA on your wallet and exchange accounts to add an extra layer of security.

- Backup Your Wallet: Regularly back up your wallet’s seed phrase or private keys and store them in a safe place offline.

- Keep Your Software Updated: Keep your wallet software and operating system updated to patch any security vulnerabilities.

- Be Wary of Phishing Scams: Be cautious of phishing emails, websites, and social media posts that attempt to steal your private keys or login credentials.

- Use a Hardware Wallet: For long-term storage of large amounts of cryptocurrency, consider using a hardware wallet.

- Never Share Your Private Keys: Never share your private keys or seed phrase with anyone.

- Use a VPN: When accessing your wallet or exchange from a public Wi-Fi network, use a VPN to encrypt your internet traffic.

- Monitor Your Transactions: Regularly monitor your wallet transactions for any suspicious activity.

- Educate Yourself: Stay informed about the latest security threats and best practices in the cryptocurrency space.

Understanding Exchange Mechanisms within Wallets

Integrated exchanges within wallets don’t typically operate as full-fledged order book exchanges like Binance or Coinbase. They often utilize different mechanisms to facilitate trading:

- Decentralized Exchanges (DEXs): Some wallets directly integrate with DEXs like Uniswap or SushiSwap, allowing users to trade directly with other users using smart contracts. This provides greater transparency and control over your funds.

- Exchange Aggregators: Wallets may use exchange aggregators that search across multiple DEXs to find the best prices for your trades. This helps to minimize slippage and maximize your returns.

- Centralized Exchange Integration: Some wallets partner with centralized exchanges to offer trading functionality. In this case, your funds are still technically being managed by a third party during the trade, even though you initiate the trade from within your wallet.

Weighing the Pros and Cons

Using a crypto wallet with integrated exchange capabilities offers undeniable advantages. However, it’s crucial to consider potential drawbacks.

Pros:

- Simplified Trading: One-stop shop for storing, sending, receiving, and trading.

- Reduced Risk: Decreases the need to hold funds on centralized exchanges, lowering exposure to potential hacks.

- Convenience: Easier to manage assets without constant transfers between platforms.

Cons:

- Potentially Higher Fees: Integrated exchange fees might be higher than standalone exchanges.

- Limited Trading Pairs: Availability of certain trading pairs might be restricted.

- Dependence on Third-Party Services: Reliance on the wallet provider and their chosen exchange partners.

- Security Risks: Even with security features, the wallet itself remains a potential target for attacks.

The Future of Crypto Wallets and Exchanges

The integration of exchange functionalities into crypto wallets is likely to become even more prevalent as the industry matures. Future developments may include:

- Improved User Experience: Wallets will become even more user-friendly and intuitive, making it easier for beginners to buy, sell, and trade cryptocurrencies.

- Enhanced Security: Wallets will incorporate more advanced security features to protect against evolving threats.

- Greater Interoperability: Wallets will support a wider range of cryptocurrencies and blockchain networks.

- More Decentralized Options: Increased adoption of DEXs and decentralized exchange aggregators will provide users with greater control over their funds and trading activities.

- Integration with DeFi: Wallets will seamlessly integrate with decentralized finance (DeFi) platforms, allowing users to earn interest, borrow and lend cryptocurrency, and participate in other DeFi activities directly from their wallets.

Conclusion

Choosing the right crypto wallet is a crucial decision for anyone involved in the cryptocurrency space. Wallets with integrated exchange functionalities offer a convenient and potentially secure way to manage and trade your digital assets. By understanding the different types of wallets, the benefits of integrated exchanges, and the security best practices, you can make an informed decision that aligns with your specific needs and risk tolerance. Always remember to prioritize security and conduct thorough research before entrusting any wallet provider with your cryptocurrency.